Executing Growth: Financial Performance and KPIs

Now that we have provided a high-level overview of financial planning and analysis (FP&A) as well as financial reporting as it pertains to growing businesses, it seems appropriate to take a closer look at the role that planning and reporting plays in executing a business strategy.

In this discussion, the following will be covered:

- Building the Right Financial Framework

- Defining Key Performance Indicators (KPIs)

- Monitoring Financial Performance

- Accountability

Building the Right Financial Framework

When it comes to financial planning and analysis (FP&A) for growing businesses, one of the fundamental aspects is building a robust financial framework. This framework serves as the backbone for the entire financial strategy and plays a critical role in achieving the business’s long-term goals. In this section, we will explore how to create a solid financial framework that aligns with a business’s stage and the competencies of its team.

Not Overcomplicating Things: Matching the Framework to the Business Stage and Team Competencies

One of the first considerations when building a financial framework is to avoid overcomplicating things. Many businesses make the mistake of adopting complex financial models or strategies that are better suited to large corporations. However, it’s crucial to tailor the financial framework to the specific business stage and the competencies of its team.

For startups and early-stage businesses, simplicity can be an ally. Start with a straightforward approach that aligns with immediate goals and resources. As a business matures, it can gradually introduce more sophisticated financial strategies. The key here is to strike a balance between the complexity of a financial framework and the ability of a team to execute it effectively.

Early in my career, having an appreciation for highly technical finance and detail-oriented analysis, I commonly made the mistake of adding too much sophistication to the task at hand. Simply put, similar to everything else in life, the sophistication of a financial framework will be subject to diminishing marginal returns and will even lead to negative marginal returns much earlier than expected for many startups. This underscores the importance of maintaining a sense of balance and practicality in financial endeavors.

Leadership teams must remain acutely aware of this principle and consistently ask themselves the following critical questions:

- Matching Finance Leadership to Business Stage: Do our current finance leadership capabilities align with the current stage of our business and the direction in which it is headed? It’s crucial to recognize that while a seasoned CFO from a Fortune 100 company may possess immense skills and experience, these attributes may not translate well when serving as a CFO for a $30 million growing business.

- Objective Definition and Outcome Quantification: In the context of finance-driven initiatives and investments, are we rigorously defining objectives, benchmarking progress, and actively seeking to quantify outcomes in a manner akin to other investments? Ensuring that financial initiatives are held to the same standards as other strategic endeavors is essential for meaningful progress and accountability.

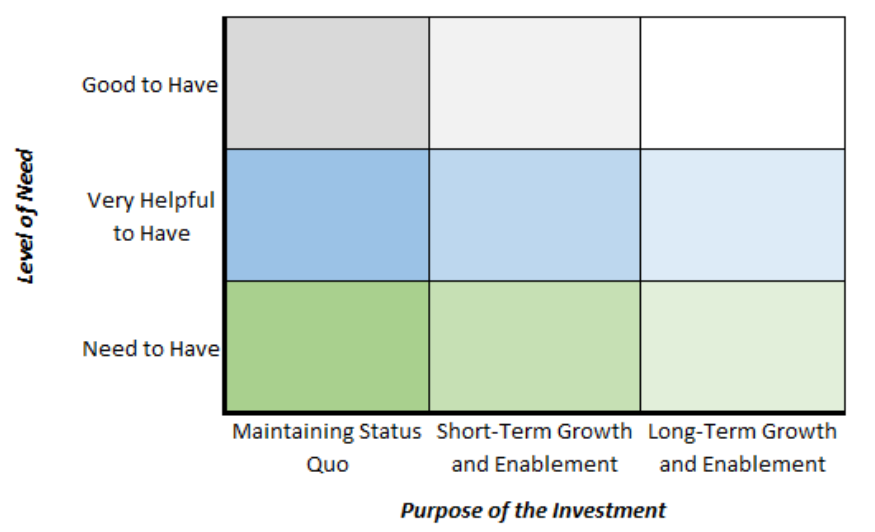

- Categorization of Investments: Consider adopting a categorization system for investments, as it can offer valuable clarity. A simplified version of the decision matrix I frequently employ is outlined below. It’s worth noting that the ultimate objective is not necessarily to push everything into the lower-left corner of the matrix, but rather to make informed decisions based on the unique characteristics of each investment.

Allocating Resources Effectively to Support Growth Initiatives

Effective resource allocation is another critical aspect of building a robust financial framework. As a business grows, it will have more opportunities and demands for investment. A financial framework should provide a structured approach to allocating resources to support growth initiatives.

The business must establish its priorities and where it sees the most potential for growth. Whether it’s expanding into new markets, launching new products, or scaling operations, the financial framework should guide how and when to allocate funds to these initiatives. By doing so, the company can ensure that resources are used strategically to drive the company forward.

Establishing Clear Financial Milestones

Within a financial framework, it’s essential to establish clear financial milestones. These milestones act as checkpoints along the path to achieving business goals. They help track progress, identify any deviations from the plan, and make necessary adjustments.

Financial milestones can include revenue targets, profitability thresholds, expense control measures, and more. By setting these milestones, a business creates a sense of accountability within the organization. Team members understand what’s expected and have a basis for evaluating their performance in relation to these financial goals.

Defining Financial and Operating Key Performance Indicators (KPIs)

In the journey of executing growth and achieving business success, Key Performance Indicators (KPIs) play a pivotal role. They serve as guiding lights, helping a business navigate the path toward its goals. In this section, we’ll delve into the intricacies of defining KPIs, understanding their evolution, and aligning them with financial milestones and the broader objectives set in a business plan.

Key Consideration:

While product and growth-related KPIs, such as churn and product usability metrics, are typically monitored by different teams within the organization, the finance team often finds value in collaborating across functions to provide guidance and establish processes for these critical metrics. This collaboration is crucial due to the impact these metrics have on resource allocation and external reporting.

However, it is important that the Finance team thinks of itself primarily as an enabler of the business’s growth and success. Sure, at times, the Finance team (often with the Legal function within) will have to be the voice of reason, but when it comes customer and product KPIs, the Finance team should be careful not to allow its cross-functional involvement in the reporting process to adversely affect the effectiveness and agility of a function’s efforts.

Using Output Metric(s) as a North Star

When it comes to defining financial and other operating KPIs, for smaller businesses, simplicity is key. Much like building a financial framework, the temptation to overcomplicate can be strong. However, it’s crucial for teams at startups and small businesses to resist this urge and focus on straightforward, output-oriented metrics that serve as its North Star.

Avoid the trap of drowning in a sea of metrics. Instead, identify core KPIs that directly reflect the business’s performance and objectives. These KPIs should be easy to understand, track, and communicate across the organization. By keeping things simple, an organization can ensure that everyone on its team can rally behind these metrics, driving alignment towards business goals.

How KPIs Shift as a Business Transforms

KPIs are not static; they evolve with a business. As a company grows and matures, its KPIs will naturally change. It’s essential to recognize this evolution and adjust KPIs accordingly. Below, we discuss how these KPIs often evolve.

Early Stage: Focus is often on cash runway and KPIs that gauge product-market fit.

- Burn rate

- Engagement and usability metrics

- Retention analysis

- Customer feedback

Early Growth: Focus is often on finding product-channel fit, then intense (but economic) growth/scale.

- Burn rate, budgeting, and cash flow targets

- Revenue growth rate

- ARPU

- CLV/CAC

Growth: Once product-channel fit has been validated and a certain scale has been met, focus is often on additional growth, moving upmarket or across markets, and improving profitability.

- Revenue growth and targets

- Margins and improving FP&A

- Cash management

- Market share

- Net retention and upselling and cross-selling metrics

- Improved capital allocation and ROI

Maturing: As the market matures, focus shifts to profitability and the achievement of extreme efficiency.

- Profit margin and profitability ratios

- Operational efficiency and utilization

- Cost Control

- Working capital management

- Sophisticated capital allocation strategy as the company seeks new efficiencies and growth avenues

Monitoring & Tracking Financial Performance

Most successful businesses don’t wait until the end of the year to assess their financial performance. Instead, they consistently monitor key financial metrics and compare them to their targets throughout the year, adjusting course as needed.

Financial KPIs: Begin by regularly tracking your chosen financial KPIs. These may include revenue, profit margins, cash flow, and other metrics relevant to your business goals. Using software and automation tools can help with improved data collection and reporting, ensuring real-time visibility into your performance.

Budget Variances: Analyze budget variances by comparing actual financial results to your budgeted expectations. Identify areas where your performance exceeds expectations and areas where you fall short. Understanding these variances enables proactive decision-making.

Scenario Analysis: Consider conducting scenario analysis to assess the impact of different economic conditions or market shifts on your financial performance. This forward-looking approach helps you prepare for various contingencies.

Key Considerations:

Again, remember that the sophistication of the above must match the stage and competencies of the business. Real-time data, updating a 12-month or 24-month budget each month, and statistical-based scenario analyses will usually not make sense for an early-stage startup.

Utilizing Financial Dashboards and Reporting Tools

In today’s digital age, most businesses have access to a wealth of financial and customer data. To make sense of this data and gain actionable insights, organizations rely on financial dashboards and reporting tools.

These tools provide at-a-glance insights into a business’s financial performance, allowing leadership and operating teams to quickly identify trends, outliers, and areas that require attention. Customized reports can also ensure that businesses are not overwhelmed with unnecessary data and can focus on what’s essential.

Some top financial reporting and visualization tools include:

- Microsoft Excel: Microsoft Excel remains a versatile and widely used tool for creating financial reports and dashboards. It’s especially suitable for startups and small businesses.

- QuickBooks and NetSuite: Accounting and ERP systems like QuickBooks and NetSuite often offer built-in reporting and analysis tools or addons. They are popular choices for managing financial data.

- ProfitWell, ChargeBee: Leveraging subscription management and analytics tools like ChargeBee, ProfitWell, and their counterparts can provide businesses (especially SaaS) with invaluable insights into their subscription-based revenue models, enabling data-driven decision-making and optimization of subscription pricing, retention strategies, and overall profitability.

- Google Data Studio: A free option from Google, Data Studio provides basic data visualization and reporting capabilities, making it a cost-effective choice for startups.

- Tableau, Power BI, and Looker: These tools are favored for their advanced data visualization and reporting capabilities. Startups may transition to them as they require more sophisticated financial reporting.

- Sisense and Domo: These platforms offer comprehensive data analytics and dashboard solutions suitable for growing businesses. They provide advanced features for in-depth financial analysis.

- Enterprise-Grade Tools: For mature businesses, enterprise-grade tools like SAP BusinessObjects or Oracle BI offer scalability, compliance, and comprehensive financial reporting features.

As a startup matures, its choice of financial reporting tools may evolve based on budget constraints and the complexity of financial reporting needs.

Key Considerations:

Although these tools and others can add powerful functionality such as AI-powered analysis and real-time data feeds, for many startups and small businesses, a simple shared spreadsheet with periodic manual data inputs will be just (if not more) effective than overcomplicating and distracting the reporting and analysis framework with sophistication

Identifying Early Warning Signs and Addressing Deviations

A financial report tells a story, and part of that story may include early warning signs of potential operating issues. It’s crucial to develop a keen eye for these signs and take swift action.

- Deviation Analysis: When reviewing financial reports, business leaders must pay close attention to any significant deviations from budgeted targets or historical trends. These deviations can signal operational challenges, market shifts, or other factors that require attention.

- Root Cause Analysis: Once identifying deviations, it is important to conduct a root cause analysis to understand the underlying factors. Was it due to a one-time event, a change in customer behavior, or an internal issue? Understanding the root causes helps formulate effective solutions.

- Action Plans: Action plans are needed to address deviations and mitigate risks. These plans should outline specific steps, responsibilities, and timelines for resolving financial challenges. Regularly track the progress of these action plans to ensure accountability.

Monitoring and tracking financial performance is an ongoing process that empowers organizations to make informed decisions, proactively address issues, and seize opportunities. It’s not a one-time task but a continuous commitment to financial health and success. By regularly assessing financial KPIs, utilizing reporting tools, and addressing deviations promptly, businesses can navigate the path to growth with additional confidence and resilience.

Accountability

Accountability is the glue that holds a financial strategy and performance monitoring together. Without it, even the most well-structured financial framework and carefully defined KPIs will be worthless as root cause analysis and action plans will lead nowhere. In this section, we’ll explore the critical aspects of accountability in financial operations and KPI management.

Accountability Starts at the Top

Effective accountability begins with leadership. Company executives and senior management must set the tone by demonstrating their commitment to financial goals and KPIs.

- Accountability Necessitates Transparency: Leadership teams should embrace transparency when it comes to financial performance. Sharing financial reports and KPI data with the entire organization fosters a culture of openness and responsibility. When team members understand how their work contributes to financial outcomes, they become more engaged and accountable.

- Teaching Teams About KPIs and Processes: Accountability is not just about assigning blame when things go wrong; it’s also about educating and empowering the team. It is essential to take the time to teach employees about the KPIs that matter most to the business and the processes in place to achieve them. Knowledge empowers teams to take ownership of their contributions to financial success.

KPI Ownership and Complete Buy-In

To maximize accountability, every team member should feel a sense of ownership over specific KPIs. When individuals take responsibility for their part in achieving KPI targets, it minimizes room for excuses and fosters a culture of empowerment and iterative improvement.

- KPI Ownership: Assign KPI ownership to individuals based on their roles and responsibilities. Ultimately, from the leadership’s perspective, a single person is responsible for each KPI. When there’s a clear owner, it’s easier to track progress and address issues promptly. I have also found that in certain instances, additional ownership results from making the owner of a KPI the one who is also responsible for accurately reporting it.

- Complete Buy-In: Ensure that all team members understand the significance of the KPIs they are responsible for and fully buy into the objectives. This alignment between individual and organizational goals is crucial for driving performance and accountability.

- Establishing KPI Targets and Review Schedules: KPIs serve little purpose unless they are actively monitoring progress. Therefore, it’s crucial, in collaboration with the KPI owner, to define KPI targets alongside review timeframes or deadlines. The frequency of KPI scrutiny varies based on KPI type and the company’s growth stage. Typical review intervals encompass continuous, weekly, monthly, or quarterly assessments.

- Empowerment and Letting Go of the Vine: Complete buy-in will not be possible if the person responsible for the KPI is not able to directly influence it. Make sure he or she has reasonable resources and empowerment to reach for the KPI target.

Key Consideration:

Assigning a KPI to one individual does not mean that the same KPI will be used to hold other team members (or entire teams) accountable. For instance, the Head of Customer Success may ultimately be responsible for the net promoter score (NPS) but may cascade the responsibility of this metric or a decomposition of such to the broader Customer Success team.

Incentives

Incentives play a vital role in reinforcing accountability and motivating teams to excel in their financial responsibilities. Consider these strategies:

- Rewarding Good Performance and Learnings: Incentive programs should recognize and reward both good performance and the lessons learned from failures. It’s important to foster a culture where taking calculated risks and learning from mistakes are encouraged.

- Handling Ongoing Bad Performance and Poor Responses: Many business owners and leadership teams have difficulty with the uncomfortable discussions. However, review and feedback is necessary, something that is much easier for businesses that systematically establish a culture of accountability and improvement. Depending on the situation and the attitude of the KPI owner, missing a KPI target is not necessarily a bad thing. Nevertheless, there are instances when continued underperformance, lack of accountability / dishonest excuses ought to result in a lost bonus, demotion, or termination.

- Periodic Reviews and Adjustments Based on Financial Performance and Business Pivots: Incentive structures should be flexible and subject to periodic reviews. As a business evolves and its financial goals shift, incentive programs should adapt accordingly. Regularly assess whether the incentives are effectively driving the desired financial outcomes. We will discuss different forms of employee compensation in a later post.

Accountability is not a one-time endeavor but an ongoing commitment to achieving and exceeding financial goals. When leadership sets the example, team members take ownership of their KPIs, and incentive programs align with objectives, a business creates a culture of accountability that strongly promotes greater financial success.

Conclusion

Although there is much more to discuss, in this overview of financial operating performance and KPIs for growing businesses, we’ve covered essential considerations for achieving long-term success.

By building a tailored financial framework, defining KPIs appropriate for the business and its goals, adapting as the business grows, monitoring performance, addressing deviations, fostering accountability, and aligning incentives, businesses can confidently pursue growth and success.